Palm Beach County Fl Property Tax Estimator . To estimate the property tax bill for a property, start by searching for the property and selecting it. how can i calculate my property taxes? our palm beach county property tax calculator can estimate your property taxes based on similar properties, and show you. Property tax is payable november 1 to march 31. while palm beach county contains lots of nice real estate, it has some hefty property taxes. the property control number can found on your tax bill. Palm beach county’s average effective property tax rate is 1.11%,. from our schools and libraries to public safety, healthcare programs and the environment, property taxes support our way of life. This simple equation illustrates how to calculate your property taxes: The millage rate is set by each ad valorem. The entire property control number. your property’s assessed value is determined by the palm beach county property appraiser.

from ips01philips.blogspot.com

from our schools and libraries to public safety, healthcare programs and the environment, property taxes support our way of life. Palm beach county’s average effective property tax rate is 1.11%,. The millage rate is set by each ad valorem. how can i calculate my property taxes? The entire property control number. our palm beach county property tax calculator can estimate your property taxes based on similar properties, and show you. your property’s assessed value is determined by the palm beach county property appraiser. To estimate the property tax bill for a property, start by searching for the property and selecting it. the property control number can found on your tax bill. while palm beach county contains lots of nice real estate, it has some hefty property taxes.

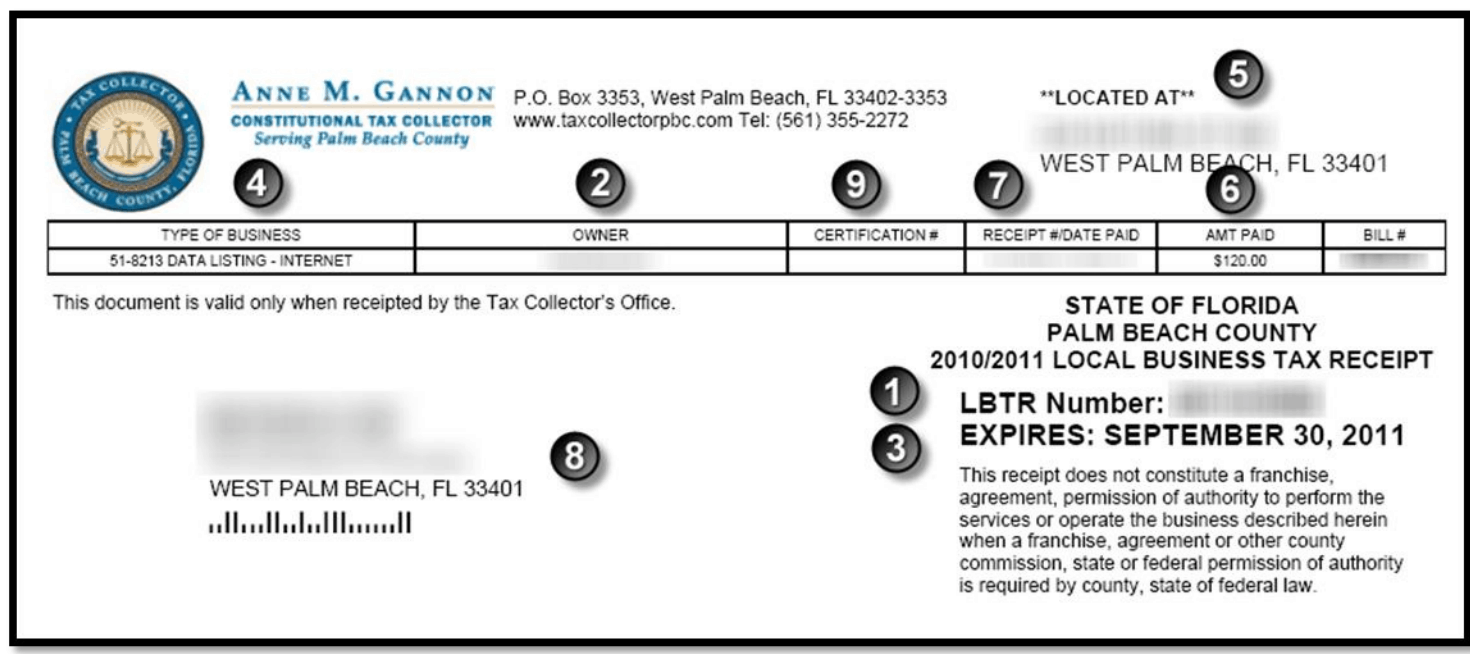

palm beach county business tax receipt phone number Notable Site

Palm Beach County Fl Property Tax Estimator Palm beach county’s average effective property tax rate is 1.11%,. from our schools and libraries to public safety, healthcare programs and the environment, property taxes support our way of life. To estimate the property tax bill for a property, start by searching for the property and selecting it. The entire property control number. our palm beach county property tax calculator can estimate your property taxes based on similar properties, and show you. how can i calculate my property taxes? This simple equation illustrates how to calculate your property taxes: Property tax is payable november 1 to march 31. the property control number can found on your tax bill. Palm beach county’s average effective property tax rate is 1.11%,. while palm beach county contains lots of nice real estate, it has some hefty property taxes. The millage rate is set by each ad valorem. your property’s assessed value is determined by the palm beach county property appraiser.

From www.realtor.com

Palm Beach County, FL Real Estate & Homes for Sale Palm Beach County Fl Property Tax Estimator the property control number can found on your tax bill. This simple equation illustrates how to calculate your property taxes: Palm beach county’s average effective property tax rate is 1.11%,. your property’s assessed value is determined by the palm beach county property appraiser. how can i calculate my property taxes? To estimate the property tax bill for. Palm Beach County Fl Property Tax Estimator.

From www.templateroller.com

Form FAMO2100 Fill Out, Sign Online and Download Printable PDF, Palm Palm Beach County Fl Property Tax Estimator our palm beach county property tax calculator can estimate your property taxes based on similar properties, and show you. Palm beach county’s average effective property tax rate is 1.11%,. from our schools and libraries to public safety, healthcare programs and the environment, property taxes support our way of life. Property tax is payable november 1 to march 31.. Palm Beach County Fl Property Tax Estimator.

From www.hauseit.com

How to Find Your Florida Property Tax Number, Folio or Parcel ID Number Palm Beach County Fl Property Tax Estimator how can i calculate my property taxes? while palm beach county contains lots of nice real estate, it has some hefty property taxes. your property’s assessed value is determined by the palm beach county property appraiser. To estimate the property tax bill for a property, start by searching for the property and selecting it. This simple equation. Palm Beach County Fl Property Tax Estimator.

From 4printablemap.com

Map Of Palm Beach County Florida Printable Maps Palm Beach County Fl Property Tax Estimator your property’s assessed value is determined by the palm beach county property appraiser. Palm beach county’s average effective property tax rate is 1.11%,. Property tax is payable november 1 to march 31. the property control number can found on your tax bill. our palm beach county property tax calculator can estimate your property taxes based on similar. Palm Beach County Fl Property Tax Estimator.

From www.palmmartin.com

Best 55+ Communities in Palm Beach County With Low HOAs Palm Beach County Fl Property Tax Estimator from our schools and libraries to public safety, healthcare programs and the environment, property taxes support our way of life. The entire property control number. Palm beach county’s average effective property tax rate is 1.11%,. To estimate the property tax bill for a property, start by searching for the property and selecting it. your property’s assessed value is. Palm Beach County Fl Property Tax Estimator.

From ips01philips.blogspot.com

palm beach county business tax receipt phone number Notable Site Palm Beach County Fl Property Tax Estimator Palm beach county’s average effective property tax rate is 1.11%,. This simple equation illustrates how to calculate your property taxes: your property’s assessed value is determined by the palm beach county property appraiser. The entire property control number. The millage rate is set by each ad valorem. from our schools and libraries to public safety, healthcare programs and. Palm Beach County Fl Property Tax Estimator.

From savepaying.com

City Of West Palm Beach Pay Water Bill & Customer Service Palm Beach County Fl Property Tax Estimator Property tax is payable november 1 to march 31. your property’s assessed value is determined by the palm beach county property appraiser. This simple equation illustrates how to calculate your property taxes: the property control number can found on your tax bill. The entire property control number. our palm beach county property tax calculator can estimate your. Palm Beach County Fl Property Tax Estimator.

From www.templateroller.com

City of Palm Beach, Florida Change of Contractor/Qualifier Form Fill Palm Beach County Fl Property Tax Estimator how can i calculate my property taxes? your property’s assessed value is determined by the palm beach county property appraiser. Property tax is payable november 1 to march 31. our palm beach county property tax calculator can estimate your property taxes based on similar properties, and show you. To estimate the property tax bill for a property,. Palm Beach County Fl Property Tax Estimator.

From www.pbcgov.org

Property Appraiser, Palm Beach County, Florida, USA Palm Beach County Fl Property Tax Estimator how can i calculate my property taxes? while palm beach county contains lots of nice real estate, it has some hefty property taxes. the property control number can found on your tax bill. Property tax is payable november 1 to march 31. This simple equation illustrates how to calculate your property taxes: The entire property control number.. Palm Beach County Fl Property Tax Estimator.

From www.neilsberg.com

Palm Beach County, FL Median Household By Age 2024 Update Palm Beach County Fl Property Tax Estimator The entire property control number. This simple equation illustrates how to calculate your property taxes: Palm beach county’s average effective property tax rate is 1.11%,. while palm beach county contains lots of nice real estate, it has some hefty property taxes. your property’s assessed value is determined by the palm beach county property appraiser. Property tax is payable. Palm Beach County Fl Property Tax Estimator.

From www.palmbeachpost.com

With Palm Beach property values up, taxbill estimates hit the mail Palm Beach County Fl Property Tax Estimator The millage rate is set by each ad valorem. To estimate the property tax bill for a property, start by searching for the property and selecting it. The entire property control number. Palm beach county’s average effective property tax rate is 1.11%,. Property tax is payable november 1 to march 31. from our schools and libraries to public safety,. Palm Beach County Fl Property Tax Estimator.

From www.usnews.com

How Healthy Is Palm Beach County, Florida? US News Healthiest Communities Palm Beach County Fl Property Tax Estimator from our schools and libraries to public safety, healthcare programs and the environment, property taxes support our way of life. our palm beach county property tax calculator can estimate your property taxes based on similar properties, and show you. the property control number can found on your tax bill. The entire property control number. To estimate the. Palm Beach County Fl Property Tax Estimator.

From www.neilsberg.com

Palm Beach County, FL Population by Race & Ethnicity 2023 Neilsberg Palm Beach County Fl Property Tax Estimator Palm beach county’s average effective property tax rate is 1.11%,. from our schools and libraries to public safety, healthcare programs and the environment, property taxes support our way of life. To estimate the property tax bill for a property, start by searching for the property and selecting it. The entire property control number. The millage rate is set by. Palm Beach County Fl Property Tax Estimator.

From www.youtube.com

HOW TO Search PALM BEACH County PROPERTY APPRAISER Site How To Find Palm Beach County Fl Property Tax Estimator Palm beach county’s average effective property tax rate is 1.11%,. The millage rate is set by each ad valorem. To estimate the property tax bill for a property, start by searching for the property and selecting it. while palm beach county contains lots of nice real estate, it has some hefty property taxes. This simple equation illustrates how to. Palm Beach County Fl Property Tax Estimator.

From propertyappraisers.us

Palm Beach County Property Appraiser How to Check Your Property’s Value Palm Beach County Fl Property Tax Estimator the property control number can found on your tax bill. The entire property control number. This simple equation illustrates how to calculate your property taxes: how can i calculate my property taxes? our palm beach county property tax calculator can estimate your property taxes based on similar properties, and show you. The millage rate is set by. Palm Beach County Fl Property Tax Estimator.

From propertytaxgov.com

Property Tax Palm Beach 2023 Palm Beach County Fl Property Tax Estimator how can i calculate my property taxes? from our schools and libraries to public safety, healthcare programs and the environment, property taxes support our way of life. The millage rate is set by each ad valorem. Property tax is payable november 1 to march 31. our palm beach county property tax calculator can estimate your property taxes. Palm Beach County Fl Property Tax Estimator.

From propertytaxgov.com

Property Tax Palm Beach 2023 Palm Beach County Fl Property Tax Estimator how can i calculate my property taxes? our palm beach county property tax calculator can estimate your property taxes based on similar properties, and show you. The millage rate is set by each ad valorem. your property’s assessed value is determined by the palm beach county property appraiser. from our schools and libraries to public safety,. Palm Beach County Fl Property Tax Estimator.

From www.townofpalmbeach.com

Property Tax Information Palm Beach, FL Official Website Palm Beach County Fl Property Tax Estimator Palm beach county’s average effective property tax rate is 1.11%,. your property’s assessed value is determined by the palm beach county property appraiser. Property tax is payable november 1 to march 31. while palm beach county contains lots of nice real estate, it has some hefty property taxes. how can i calculate my property taxes? from. Palm Beach County Fl Property Tax Estimator.